CRMs, dashboards, BI tools — we’ve never had more information about our pipelines. And yet, when it comes time to call the number, confidence is often lower than it should be. That disconnect is telling.

The problem isn’t access to data. It’s that very little of it actually helps answer the questions that matter:

- Which deals are real?

- Where is the risk?

- What is likely to close — and why?

Too much of what we look at is descriptive, not diagnostic. It tells us the current state of play, or what someone hopes will happen next, but rarely highlights exactly what has changed and what hasn’t, and how the current pipeline compares to past performance, patterns, or outcomes. Without that context, it’s hard to know whether what we’re seeing is genuinely healthy or quietly off track.

So we end up with forecast calls that feel busy, but not clarifying. Lots of numbers. Not much insight.

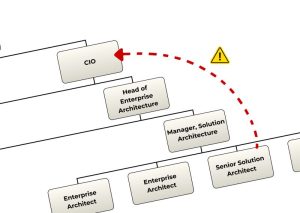

Over time, this creates a strange dynamic. Leaders ask for more data to compensate for uncertainty, which only adds noise. Sellers are burdened with more fields to fill in. Compliance — and therefore data quality — is invariably patchy.

Insight doesn’t come from volume. It comes from discipline.

From consistently inspecting the right signals, asking harder questions, and grounding today’s pipeline in what history is actually telling us — while there’s still time to act.

Until we solve that, more data won’t make forecasts any more predictable. It’ll just give us more to look at while we guess.