In sales we spend a lot of time talking about value. And fair enough.

A clear value proposition is how you get attention, build interest and move a deal forward. You need hard, defensible business outcomes, and enough proof to satisfy a sceptical buyer.

When I joined Salesforce in 2013 to lead financial services, we had all of that. Strong value messages. Local champions who swore by the platform. Global customers with extraordinary results. The value story wasn’t the issue.

But the business almost stalled. And the reason was simple: Risk.

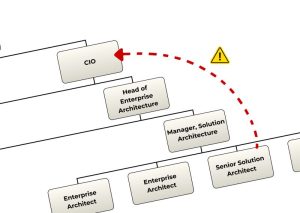

Financial services moving to the cloud triggered every alarm in the building: the regulator, internal risk teams, IT, boards…everyone got involved.

Hosting Australian customer data offshore was the issue of the day, and it didn’t matter how strong our value story was. If the perceived risk outweighed the reward, the deal didn’t move.

It’s obvious in hindsight that a conservative industry like banking would react this way. But this dynamic shows up in every sector.

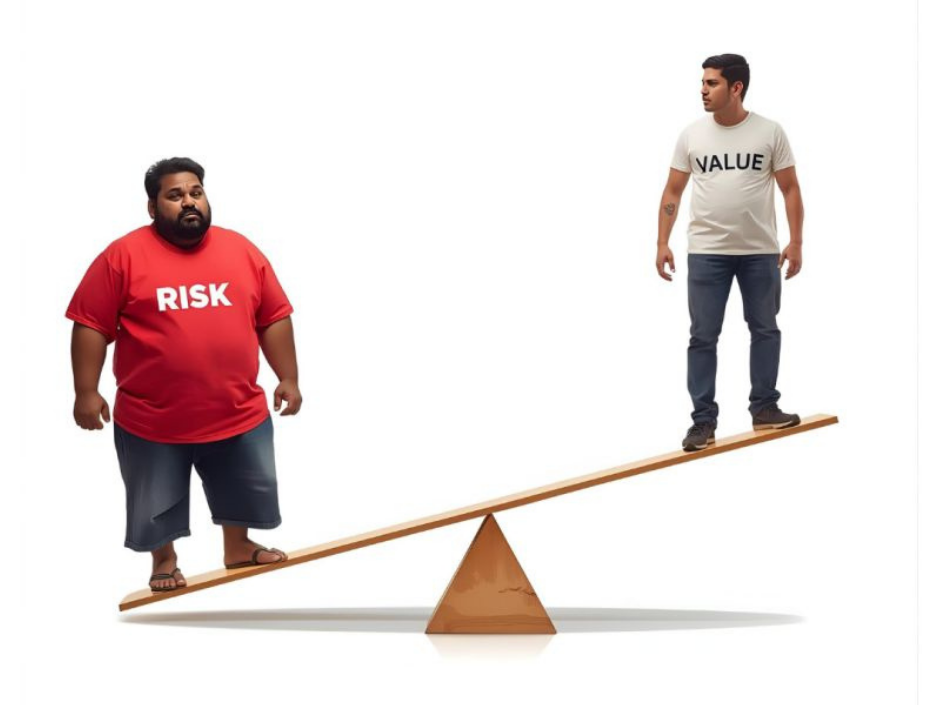

Risk outweighs value more often than not. But how we sell rarely reflects that.

Every decision is framed as risk versus reward, and when the balance tips the wrong way, deals stall, or worse: go to the vendor who handled risk better. You don’t lose because the value isn’t clear. You lose because the risk wasn’t addressed.

All sellers have a value proposition. Far fewer have a risk proposition.